In a world brimming with financial noise and fleeting advice, achieving lasting prosperity demands a more profound, integrated approach.

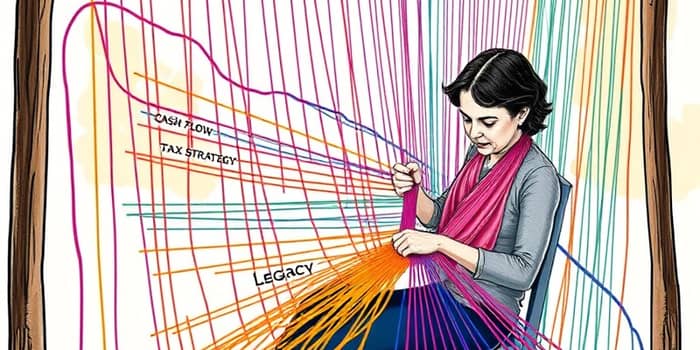

Welcome to the art of the Wealth Weaver, where financial growth is interwoven with purpose to craft a resilient and fulfilling life tapestry.

This transformative mindset shifts your focus from mere asset accumulation to creating a cohesive design that blends wealth, legacy, and personal values seamlessly.

Imagine your financial journey as a loom, with you as the artisan weaving threads of strategy into a masterpiece that endures.

By embracing this metaphor, you can move beyond isolated tips and toward a holistic framework that ensures every decision supports your broader aspirations.

At its core, the Wealth Weaver concept empowers you to see money management as an art form, where each thread represents a vital aspect of your financial life.

You are not just saving or investing; you are carefully intertwining elements like cash flow, risk management, and legacy planning to build a robust fabric.

This approach emphasizes that true wealth transcends numbers, encompassing security, impact, and fulfillment in a multidimensional tapestry.

By viewing yourself as a weaver, you align every financial action with your personal ethos, creating a tapestry that reflects who you are and what you cherish.

Current economic realities make an integrated financial strategy more crucial than ever, as isolated approaches often fall short in today's complex landscape.

With life expectancies rising, retirements now often span 25 to 30 years, demanding robust plans to prevent outliving your assets and ensure lifelong comfort.

Persistent inflation erodes purchasing power, highlighting the need for investments that outpace price increases rather than relying on stagnant savings.

Market volatility and frequent crises underscore the importance of diversification to safeguard your wealth tapestry during turbulent economic times.

Additionally, there is a growing shift toward values-based investing, where financial goals are intertwined with social and environmental impact for a meaningful legacy.

This context justifies why random tips are insufficient; a woven, adaptive strategy is essential for navigating modern financial challenges with confidence.

Every great tapestry starts with a strong base, and in wealth weaving, that foundation is built through diligent cash flow management and saving habits.

Track your income versus expenses meticulously to build a stable financial groundwork that supports all future goals and aspirations.

An emergency fund covering three to six months of expenses provides a crucial safety net against life's surprises, ensuring stability in uncertain times.

Avoiding chronic negative cash flow is vital, as it can lead to high-interest debt that hinders growth and unravels your financial fabric.

The wealth pyramid concept visualizes this foundation, with layers that progressively support your financial structure from stability to growth.

Adopt a simple yet powerful loop: make money, save a portion, invest those savings, and repeat consistently to fuel continuous growth.

For example, saving $200 per month at a 7% annual return for 30 years can grow to approximately $240,000, demonstrating the profound power of compounding in your wealth tapestry.

Your financial goals are the pattern you weave into your wealth tapestry, giving it direction, meaning, and alignment with your deepest desires.

Align your plan with personal values and lifelong aspirations to ensure every thread contributes to a life of fulfillment and purpose.

Consider lifestyle needs such as housing, healthcare, travel, and education, both in the present and for retirement, to estimate necessary funds accurately.

Factor in supporting loved ones through initiatives like funding their education or providing caregiving assistance, weaving family into your financial design.

Define charitable goals to incorporate philanthropy, whether through annual donations or structured giving vehicles, adding impact to your legacy.

Segregating capital by purpose using a buckets approach adds clarity and focus, allowing you to allocate resources efficiently toward specific objectives.

This structured approach ensures that each part of your wealth serves a defined role, reducing confusion and enhancing the coherence of your financial tapestry.

Investing is the vibrant thread that adds color and texture to your wealth tapestry, driving financial growth and enabling you to achieve autonomy over time.

Its primary purpose is to make money work for you autonomously, achieving freedom and outpacing inflation through disciplined, long-term strategies.

Key concepts include compounding, where reinvested earnings generate additional returns, amplifying wealth across horizons and turning patience into profit.

Understand your time horizon and risk tolerance to tailor an investment approach that balances aggressive growth with necessary security for peace of mind.

By weaving these threads together, you create a diversified investment strategy that supports both preservation and growth, adapting to your life stage and goals.

Diversification spreads risk across various asset classes, sectors, and geographies, protecting your wealth tapestry from unraveling during economic downturns.

Focus on complementary assets that work in harmony rather than haphazard allocations that may increase vulnerability and lead to unnecessary losses.

Wealth preservation involves safeguarding assets from volatility, while wealth growth seeks higher returns through disciplined risk-taking, balancing caution with opportunity.

Avoid concentration risk by not over-investing in single stocks or undiversified business ventures, which can threaten your financial fabric if they fail.

Use a balanced mix of equities, bonds, real estate, and cash equivalents to weather market fluctuations and ensure resilience in changing conditions.

Consider risk-adjusted returns, prioritizing stability and consistency alongside aggressive growth strategies to optimize outcomes without compromising security.

Tax efficiency is a critical thread that strengthens every other aspect of your wealth, freeing more capital for investment and enhancing overall growth potential.

Minimize taxes legally to maximize after-tax returns and compounding effects over the long term, turning tax savings into additional wealth-building resources.

Leverage tax-advantaged accounts, deductions, and credits to optimize your financial outcomes, reducing liabilities and increasing net gains significantly.

By weaving tax strategy into your financial tapestry, you ensure that every dollar is optimized, supporting sustainable growth and legacy building without unnecessary drag.

Debt can be a powerful tool when used strategically, but it requires careful handling to avoid pitfalls that could tear your financial fabric.

Avoid high-interest consumer debt and instead use leverage to control more assets wisely and amplify potential returns, turning borrowed capital into growth opportunities.

For example, using debt for real estate investments can enhance profitability if properties appreciate and cash flow is managed, but it demands prudence.

Fixed-rate debt acts as an inflation hedge, allowing you to repay with cheaper dollars over time, providing a strategic advantage in rising price environments.

By integrating debt thoughtfully, you add a dynamic thread to your tapestry that can enhance growth while minimizing risks through careful planning and oversight.

For those with surplus assets, separating preservation from perpetual growth adds depth and longevity to your wealth tapestry, ensuring it serves both current and future generations.

Allocate assets needed for lifestyle to high-certainty, stable investments to ensure security and peace of mind, covering essential expenses without worry.

Direct excess capital to perpetual growth strategies, focusing on long-term impact and higher returns beyond your lifetime, weaving legacy into your financial design.

This advanced approach ensures that your wealth tapestry not only sustains you but also extends its impact, weaving a story of growth and generosity that endures.

As a Wealth Weaver, you hold the shuttle to craft a financial legacy that endures through generations, blending strategy, purpose, and action into a cohesive whole.

By intertwining these elements consistently, you can achieve sustainable growth and profound personal fulfillment, turning financial management into an art that enriches every aspect of life.

Begin today by assessing your threads—cash flow, investments, goals—and start weaving the unique tapestry of your wealth journey, one deliberate stitch at a time.

References